Press releases

Press releases

9 November 2023

Half Year Results for the six months to 30 September 2023 (unaudited)

Press releases

Press releases

6 July 2023

Wincanton Partnership Shortlisted for British Construction Industry Award

Press releases

Press releases

9 May 2023

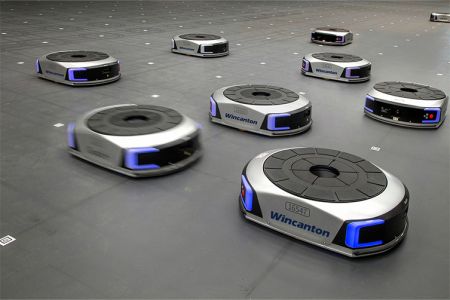

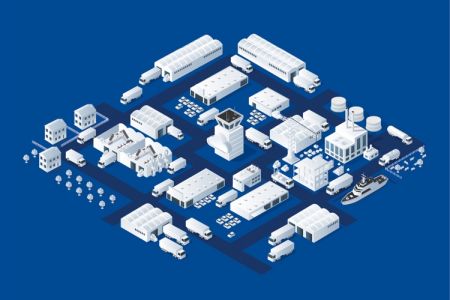

Wincanton to operate IKEA UK’s new multi-million-pound distribution centre

Press releases

Press releases

5 November 2020